First Choice have 25 years experience in raising money for our customers using the equity in their property in various ways. To discover all of the alternatives available to homeowners and mortgage payers through our vast knowledge and to get free quotations detailing exactly how much you can get and how much it would cost with obligation call our adviser team on 0800 298 3000 or Enquire online via ourreleasing equity options form. If you want to call from a mobile dial our mobile friendly number, 0333 003 1505. Our finance advisers can give you qualified advice, help you assess the most appropriate way of releasing equity from your home and give you an idea of all of the different ways you could reach your goal of freeing up equity that you have worked hard to build up and now wish to utilise.

Equity Release Mortgages For The Over 55`s: The Basics

Whilst many of the younger generations don`t realise it yet, the equity that you have built up in your home can be used to fund your lifestyle later on in life. Essentially, there are many different ways of releasing equity from your home but to provide a nest egg for your retirement days often equity release comes up trumps.

Whilst many of the younger generations don`t realise it yet, the equity that you have built up in your home can be used to fund your lifestyle later on in life. Essentially, there are many different ways of releasing equity from your home but to provide a nest egg for your retirement days often equity release comes up trumps.To put it plainly, equity release allows you to release cash from your home without either the expense or upheaval of having to move house. It provides an option for you to live in a home that you might have lived in for years, worked hard to create equity in and still use that equity to help give you a better standard of living in your later years. First Choice offers products from lifetime mortgage providers to facilitate the releasing of equity. For more information on our equity release products or to establish whether you might be eligible simply give us a call on the above number to speak to one of our understanding finance team.

Downsizing To Release Equity From Your Home

Downsizing your property is another different option for releasing equity from your home. By moving into a smaller home you can use the amount over and above your new purchase price from the sale of your existing property as capital for whatever reason you see fit. Unfortunately when downsizing from your property, it means you have to sell it to release the equity. This means that if you want to release equity, you could end up selling a property that you might have spent a lifetime making memories in. This can be a hard decision to face for many of us and is one of the many reasons many of us consider other options for releasing equity from your home, options that could allow you to carry on making those memories. It is important to take into account the emotional aspect of the different ways of releasing equity so that you can be better off both financially and emotionally. Bear in mind that equity release through a lifetime mortgage incurs interest over the whole term and this is added ongoing throughout the term of the loan. This may mean that you could end up having no equity left in your property to leave in your will.

Downsizing your property is another different option for releasing equity from your home. By moving into a smaller home you can use the amount over and above your new purchase price from the sale of your existing property as capital for whatever reason you see fit. Unfortunately when downsizing from your property, it means you have to sell it to release the equity. This means that if you want to release equity, you could end up selling a property that you might have spent a lifetime making memories in. This can be a hard decision to face for many of us and is one of the many reasons many of us consider other options for releasing equity from your home, options that could allow you to carry on making those memories. It is important to take into account the emotional aspect of the different ways of releasing equity so that you can be better off both financially and emotionally. Bear in mind that equity release through a lifetime mortgage incurs interest over the whole term and this is added ongoing throughout the term of the loan. This may mean that you could end up having no equity left in your property to leave in your will.Is A Remortgage An Option To Release Equity?

Remortgages are a popular way of releasing equity from your home and can be an effective way of raising cash for a number of purposes. Home improvements? A new car? An around the world cruise? Or to get on top of those pesky credit cards or personal loans with debt consolidation? Clearly there are a variety of different ways that releasing equity from your home through a remortgage can increase your quality of life and it is usually up to you how you spend the capital. If your mortgage is a capital and repayment mortgage, over the years each payment will be reducing the amount of mortgage you owe whilst increasing the equity that you are building up. With the recent boom in the housing market around most of the UK, your property value may be greater than you initially realised and you could have a substantial amount of equity sat in your home. With a remortgage you can raise more money against your property value and the equity you have built up and some remortgage plans go up to 95% of your property value. To work out how much equity you currently have head over to ourloan to value calculator , by working out your loan to value (LTV) you can figure out the percentage of the property you currently own and how much more you might be able to raise. Then give us a call on 0800 298 3000 to find out how much your repayments will be over the term you require.Secured Loans For Homeowners Can Release Equity

Secured loans are a well established way of people who have a mortgage on their home and consumers who own their home outright releasing the funds tied up via the equity in their property. Secured loans sit behind your mortgage as a second charge, hence they may also be known as second mortgages. They have a suite of lenders within the secured market some of which are prepared to help those who have adverse credit or a short employment history. For those without any poor credit or mortgage arrears rates can be quite low and therefore it is worth exploring this option particularly if you are locked into a mortgage deal at the moment and would incur significant costs (such as early repayment charges). You can raise from a minimum of £3000 to a maximum of around £150,000 if you qualify for this route. To find out more give us a call or fill in our short form starting at the top right of this page.Next Steps If You Wish To Release Equity From Your Home

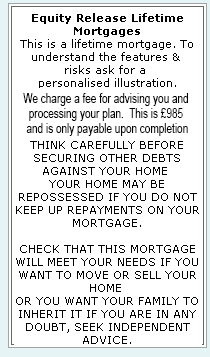

After reading up on the different ways to release equity, I am sure you will have come to realise there are several different options facing you and deciding which is right can be a daunting task. With all of the options and deals to consider you may want to come to a directly authorised business like ourselves, with over 25 years experience in the market and a wide selection of plans available. To help you explore your options in a simple and clear manner why not contact First Choice to speak to an experienced adviser. Many of our advisers are qualified to provide you with advice for both remortgages and equity release so it shouldn`t take more than a few questions to get you on the right route. We can even provide you with a completely free, no obligation quote so you can see exactly how the different ways of releasing equity from your home might help you financially. Contact us on 0800 298 3000 (landline) or 0333 003 1505 (mobile friendly). Equity Release Lifetime Mortgages |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential